When importing a car from the USA to the UK, you'll typically face an import duty of 10% and a VAT of 20%, calculated based on the combined costs of the purchase, shipping, and insurance. The entire delivery process usually spans around 8-10 weeks, contingent on the shipping method and company selected.

Considering shifting a car from the USA to the UK? it's necessary to be aware of the associated costs. Typically, the UK levies an import duty of 10% and a VAT of 20% on the cumulative costs of the vehicle's purchase, shipping, and insurance. While the process might seem daunting, understanding the breakdown of these charges and the expected delivery timeline, which is usually around 8-10 weeks, can help you plan better. This article delves deeper into the intricacies of the tax and other related aspects of bringing a vehicle from the USA to the UK.

General Overview of Importing Cars from USA to UK

Importing a car from the USA to the UK involves several steps and considerations. First of all, one must check if the vehicle meets the specific requirements set by both countries. It's crucial to ensure that your chosen vehicle complies with UK standards for emissions, safety, and other regulatory measures before initiating any purchase or process.

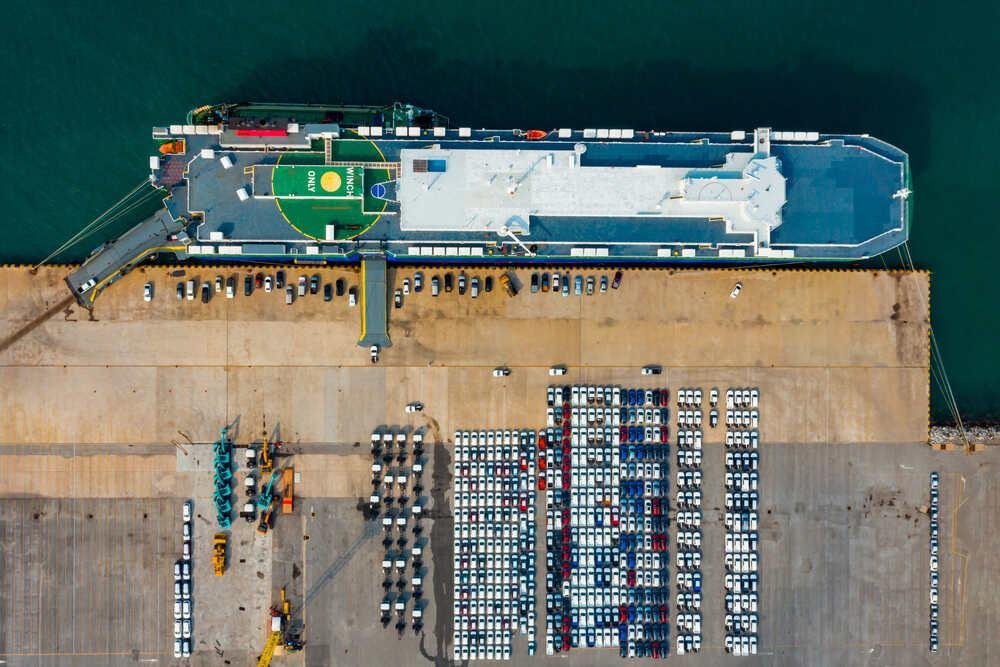

The next step is shipping which can be done either by sea freight or air freight. Sea freight is often less expensive but takes longer time while air freight offers speed at a higher cost. The choice between these two options largely depends on individual preferences and budgetary constraints. Once landed in the UK, customs duties need to be paid based on various factors including the age of the auto, and its value among others.

After paying all necessary fees and taxes at customs clearance, it's important to register your vehicle with the Driver Vehicle Licensing Agency (DVLA). This registration process includes providing documentation about your identity, and proof of ownership of the vehicle along with completed application forms as per DVLA guidelines. After successful completion of this step, you will receive a new registration document making you the legal owner of your imported car in the UK.

Vehicle Specifications and Their Effect on Tax

Vehicle specifications play a pivotal role in determining the tax on vehicles. The UK customs authorities use these details to calculate the amount of duty and VAT that needs to be paid. Factors such as engine size, fuel type, age, and value of the vehicle are taken into account. For instance, cars with larger engines or those running on diesel tend to attract higher taxes due to environmental considerations.

Additionally, modifications made to a vehicle can also influence the import tax levied. If significant alterations have been carried out that increase its market value or change its original category classification, this could result in an increased tax rate. This includes changes like engine swaps or extensive bodywork modifications.

It should be noted that classic cars over 30 years old may qualify for reduced rates if they meet certain criteria such as being preserved in their original state without substantial changes. However, it is always advisable for individuals hauling vehicles from the USA to seek professional advice before proceeding with transactions; understanding how different vehicle specifications impact taxation can help avoid unexpected costs upon arrival in the UK.

Frequently Asked Questions

What are vehicle import taxes?

Vehicle import taxes are fees charged by a country's government when a citizen imports a vehicle from another country. These fees can vary based on several factors, including the car's specifications, age, and value.

How do vehicle specifications affect import tax?

Vehicle specifications can significantly affect the import tax. Factors such as the size of the engine, fuel consumption, the type of fuel used, and even emission levels can influence the amount of tax levied. Generally, vehicles with larger engines or higher emissions may attract higher taxes.

How do I import a car from the USA to the UK?

Importing a car from the USA to the UK involves several steps. First, you need to ensure the vehicle meets UK safety and environmental standards. Then, you need to pay the necessary import duties and VAT. You must also register the vehicle with the DVLA (Driver and Vehicle Licensing Agency) and get it insured.

Can I import any type of vehicle into the UK?

Yes, you can import almost any type of vehicle into the UK. However, the vehicle must meet specific safety and environmental standards. Cars that are over ten years old may have to meet even more stringent rules.

Is it more expensive to import a newer or older car?

The age of the car can affect the import tax. Generally, older cars may attract higher import taxes due to their higher emission levels. However, this can vary depending on the specific regulations in place at the time of import. It's always best to check with the relevant authorities before proceeding with the import.

Share on Facebook

Share on Facebook Share on LinkedIn

Share on LinkedIn Share on Twitter

Share on Twitter

Google

Google  Instagram

Instagram  Trustpilot

Trustpilot