Yes, you can import a car from Poland, but it requires adherence to specific legal and procedural steps. For new cars, a Certificate of Conformity (CoC) issued by the vehicle manufacturer is necessary. For used cars, presenting a Polish registration certificate is mandatory. These documents ensure the vehicle meets the importing country's standards and regulations, facilitating a smoother customs clearance process.

From Poland involves navigating through a series of regulatory requirements and logistical challenges. Whether the car is new or used, specific documents such as the Certificate of Conformity for new cars or the Polish registration certificate for used ones are essential for registration in the destination country. Engaging with professional moving and relocation services experienced in international car shipping can significantly ease the process. These services not only assist in handling the paperwork but also ensure compliance with both Polish export laws and the importing country's import regulations, making the entire process more manageable and less daunting.

Assessing the Legalities of Importing a Car from Poland

It might be challenging to navigate the complex laws of importing a Polish car. Moving and relocation agencies can help with automobile movement but may not help with legal issues. Thus, anyone considering this venture must follow the rules exporting rules and learning legislation.

First, examine Poland's automobile export laws to confirm legality. This involves asking the Polish customs office regarding automobile export permits and documents. Contact your local vehicle registration office to explain the paperwork, insurance, and taxes needed to register an imported car. Understanding these laws is crucial because mistakes can result in fines, vehicle impoundment, or prosecution.

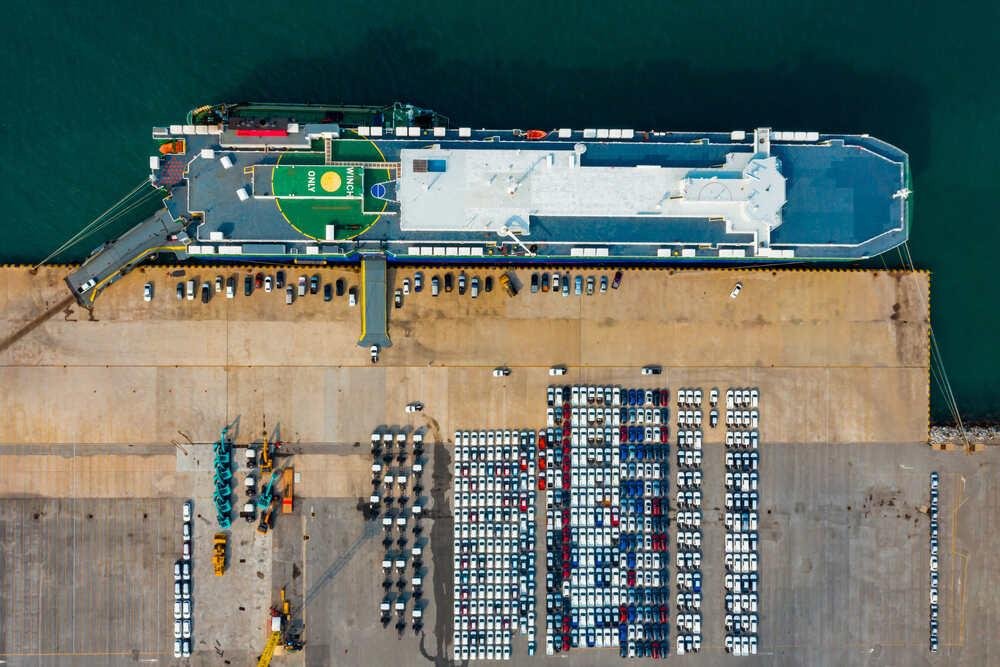

Determining the Costs Involved in Importing a Car

Several costs can affect the final cost of importing an automobile. These include shipping, import charges, taxes, and the vehicle price. Modifications to fulfill destination country standards, port warehousing fees, customs brokerage fees, and local transport costs to deliver the car may also be required.

A prevalent myth is that car importing may be done DIY. In practice, the process is typically complicated. Professional moving and relocation services can save money over time. From scheduling the car's export from its home country to navigating the destination's rigorous customs processes, these organizations have the skills and experience to manage everything. This might save importers time, worry, and money from importation mistakes.

The Role of Customs Duties in Car Importation

Importing an automobile requires customs duties, especially when using moving and relocation services. It adds considerable costs and ensures international commerce legality. These fees depend on car type, value, and destination country import rules. Consulting a customs broker or specialist before moving can help. They can explain documents, exemptions, and customs duties.

However, paying customs duties ensures easy border crossing for imported autos. This makes it crucial for reputable moving and relocation services. After customs clearance, the importer can take possession of the automobile. This ensures lawful and successful import operations. Individuals importing cars for personal or commercial usage must determine customs duties as part of their budget and legal compliance.

Frequently Asked Questions

Customs duties serve as a tax imposed on goods when they are transported across international borders. In car importation, customs duties ensure that the imported goods comply with domestic trading regulations and that appropriate taxes are paid.

Customs duties for car importation are typically calculated based on the value of the car, its type, and its origin. The exact rates can vary significantly from country to country and may depend on existing trade agreements between governments.

In some cases, customs duties can be reduced if the imported car falls under specific categories or if trade agreements exist between the exporting and importing countries. However, it's essential to note that attempting to evade customs duties can lead to severe penalties, including fines and legal action.

The customs duties are generally paid at the port of entry. After the car arrives, a customs declaration is filled out, detailing the car's value and other relevant information. The customs agency then calculates the duty owed, which must be paid before the vehicle can be legally imported.

No, customs duties are just one aspect of the total cost of importing a car. Other expenses may include shipping and handling fees, insurance, taxes, and potential modifications to meet local safety and emissions requirements.

Share on Facebook

Share on Facebook Share on LinkedIn

Share on LinkedIn Share on Twitter

Share on Twitter

Google

Google  Instagram

Instagram  Trustpilot

Trustpilot